7 Sole Trader Expenses to Claim in 2025: Maximize Your UK Tax Deductions

Cut your tax bill claim £000s in sole trader expenses. 2025 guide: home office, mileage, equipment + HMRC-approved strategies. Reduce tax liability today.

FINANCE

Rudra Prakash Parida

12/26/202511 min read

Introduction

As a sole trader, every pound you fail to claim in allowable expenses costs you real money in unnecessary tax payments.

Most UK sole traders unknowingly leave thousands of pounds unclaimed each years imply because they don't understand which business expenses qualify for tax relief. The difference between a thorough expense claim and a basic one can easily be £2,000–£5,000 in additional tax liability.

This guide walks you through every allowable expense you can claim, the strategic methods to maximize your deductions, and common pitfalls that cost sole traders money. Whether you work from home, run a service-based business, or manage a product-based operation, the proven strategies here will help you optimize your tax position for 2025/26.

Understanding Sole Trader Expenses: The Foundation

Before diving into specific expenses, you need to understand the golden rule that governs all HMRC expense claims.

An expense is allowable if it's "wholly and exclusively" for business purposes. This phrase appears repeatedly in HMRC guidance because it's the legal foundation for every deduction you make. Personal expenses, hybrid costs (like a home that's half-business, half-personal), and general lifestyle costs don't qualify.

The practical implication is straightforward: if you use something partially for business and partially for personal reasons, you can only claim the business proportion. If you work from home but also use your office as a hobby room, HMRC expects you to apportion the costs fairly typically based on square footage or hours used.

Why does this matter? Because understanding this principle helps you identify expenses you might otherwise miss, while also keeping you compliant and audit-safe. Over-claiming by lumping personal expenses into business costs triggers investigations. Under-claiming simply means you pay more tax than necessary.

The best approach is systematic: track business expenses meticulously, keep all receipts, and understand which categories apply to your specific business model.

The Most Valuable Sole Trader Expenses to Claim

The expenses covered in this section generate the largest tax savings for most sole traders. Prioritize these categories when reviewing your 2025 spending.

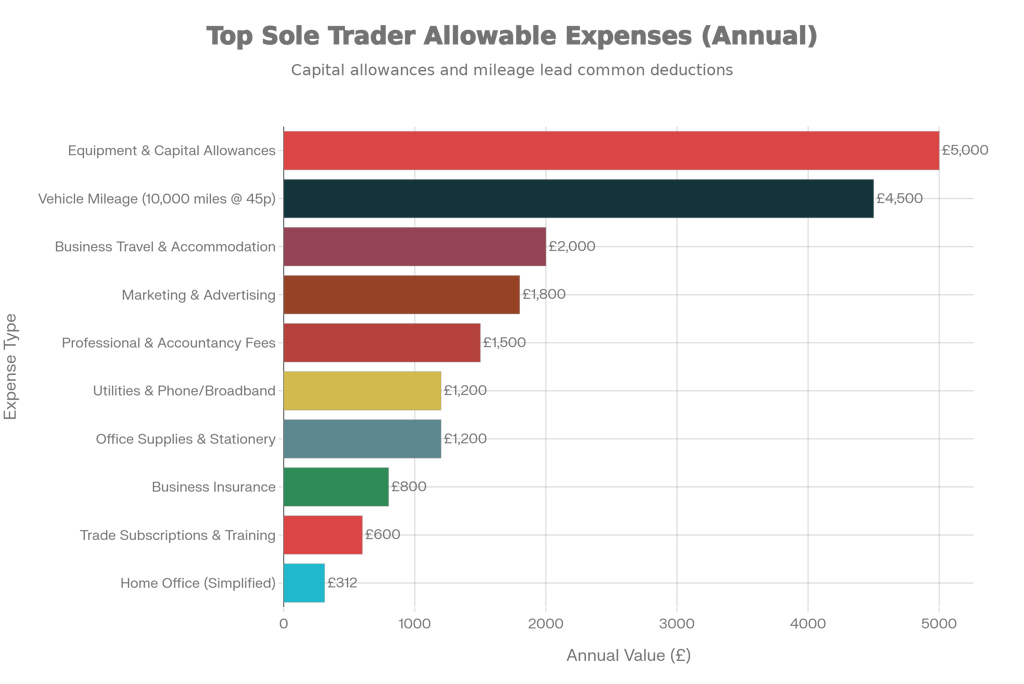

Home office deductions top the list because they're substantial yet often overlooked. Vehicle mileage ranks second due to the generous 45p-per-mile rate. Equipment and capital allowances come third because they can generate £3,000–£10,000+ in deductions if you've invested in business tools or technology.

Understanding which expenses fall into "high value" versus "routine" helps you focus your record-keeping efforts where they matter most.

Home Office Deductions: Your Biggest Tax-Saving Opportunity

Working from home has become standard for many sole traders, and HMRC recognizes this with generous home office allowances.

You have two distinct methods to claim home office expenses: the Simplified Method (flat-rate) and the Actual Costs Method. Choosing the right one depends on how many hours you work from home and your actual household costs.

Simplified Method (Recommended for Most)

The flat-rate approach offers simplicity and speed:

£10 per month if you work 25–50 hours monthly (£120/year)

£18 per month if you work 51–100 hours monthly (£216/year)

£26 per month if you work 101+ hours monthly (£312/year)

This translates to £120–£312 annually, requires no receipts, and HMRC rarely challenges these claims. The beauty of the simplified method is administrative ease no need to calculate utilities or track business-use percentages.

Actual Costs Method (Higher Potential Returns)

If you work from home extensively, this method often yields significantly higher deductions:

Calculate your true household expenses: utilities, insurance, maintenance, rent (if applicable)

Work out the business-use percentage (typically based on room square footage or hours worked)

Claim that proportion as an allowable expense

If you work from home 30+ hours weekly, the Actual Costs Method often yields £1,000–£2,500 annually compared to £312 under the simplified approach.

Which Method Should You Choose?

Home Office Comparison Visual

Top 10 Allowable Sole Trader Expenses: Annual Value Guide (2025)

Choose Simplified Method if:

You work from home part-time (under 100 hours monthly)

Your household costs are modest (rent/mortgage is personal, not business)

You value simplicity over maximum deduction

You don't want to track utility bills and square footage

Choose Actual Costs Method if:

You work from home 30+ hours weekly

Your utility bills are substantial (£150+ monthly)

You pay rent or mortgage specifically for workspace

You're willing to maintain detailed records

Example: Sarah works from her spare bedroom 40 hours weekly. Under simplified method, she claims £18/month = £216/year. Under actual costs, her utilities (£120/month × 20% business use = £24/month) + insurance (£8/month × 10%) + maintenance (£6/month) = £38/month = £456/year. Actual method saves her £240 annually.

Vehicle Mileage & Travel Expenses

Business-related vehicle costs represent one of the largest expense categories for many sole traders.

The current HMRC approved mileage rates are:

45p per mile for the first 10,000 business miles in the tax year

25p per mile thereafter

This generous rate covers fuel, insurance, maintenance, and depreciation. You don't claim each separately; the 45p/25p rate encompasses everything.

How to Calculate Your Mileage Claim

To claim, multiply your business miles by the applicable rate. If you drove 12,000 business miles this year:

10,000 miles × 45p = £4,500

2,000 miles × 25p = £500

Total claim: £5,000

Keep a mileage log to substantiate your claim. At minimum, record the date, journey purpose, and miles traveled for a sample period, then extrapolate annually. Digital apps like Citymapper or MileIQ automate this, reducing audit risk.

Other Travel Expenses You Can Claim

Beyond mileage, numerous travel costs qualify:

Train, bus, and taxi fares for business journeys

Hotel accommodation for overnight business trips

Reasonable meal expenses while traveling (not dining companions' costs)

Parking fees and tollway charges

Flight costs for business travel

What You Cannot Claim

Be clear on the boundary between allowable and non-allowable travel:

Commuting between home and your regular office (considered personal travel)

Meals while working at your regular location

Entertainment expenses or client hospitality

Parking fines or traffic violations

Example: Marcus drives 8,000 business miles annually (client visits) but also commutes 15,000 miles to his regular office location. He can only claim the 8,000 business miles = 8,000 × 45p = £3,600. His commute is personal, not business travel.

Professional Fees & Accountancy Services

Paying an accountant to prepare your business accounts and self-assessment tax return is a tax-deductible expense but with an important caveat.

Only the portion of accountancy fees related to business work qualifies. If your accountant's invoice bundles personal tax return preparation with business accounts, you must separate them. You can only claim the business portion.

What You Can Claim

Preparation of annual business accounts

Self-assessment tax return completion (business sections only)

Tax planning advice specific to your business

Professional advice on business structure or VAT registration

Bookkeeping service fees

Payroll preparation services (if you employ staff)

What You Cannot Claim

Personal tax advice unrelated to business

General financial planning services

Fees for dealing with personal tax issues

Tax return filing for other family members

Typical accountancy fees range from £300–£1,500 annually depending on business complexity. Request itemized invoices from your accountant clearly separating business and personal work. This protects you in an audit and ensures you claim correctly.

Office Supplies, Equipment & Software

Day-to-day business running costs are genuinely allowable and often overlooked.

Consumable Supplies You Can Claim Immediately

Stationery, printer ink, and printing costs

Postage and courier fees

Office furniture (desks, chairs, shelving)

Computer hardware and peripherals

Software licenses and subscriptions

Mobile phone bills (business use proportion)

Broadband and landline costs (business use proportion)

Books, journals, and learning materials for your trade

Important Distinction: Cash Basis vs. Accruals Accounting

If you use cash basis accounting (which most sole traders use), you can claim equipment costs as immediate expenses. Under traditional accruals accounting, equipment is subject to capital allowances instead.

Ask your accountant which accounting method you're using. This determines how you claim larger equipment purchases.

Capital Allowances: Long-Term Asset Deductions

Capital allowances apply to assets you buy to keep for business use vehicles, machinery, equipment that lasts multiple years.

The Annual Investment Allowance (AIA) lets you claim 100% of qualifying capital expenditure up to £1,000,000 in a single year. For most sole traders, this means you can deduct the full cost of a business computer, vehicle, or tools in the year you purchase them.

Qualifying Assets Include

Business vehicles (with special rules for cars based on CO2 emissions)

Plant & machinery (tools, manufacturing equipment, etc.)

Office equipment (computers, printers, desks)

Certain building fixtures (specialist equipment installed as fixtures)

How to Claim

If you spend, say, £3,000 on a laptop and camera equipment this year, both qualify for capital allowances under the AIA. You claim the full cost as a deduction, reducing your taxable profit.

Example: Elena, a freelance photographer, purchases a new camera (£2,000), lighting equipment (£800), and computer monitor (£400). Total: £3,200. Under the AIA, she claims the full £3,200 as a business deduction in the year of purchase, reducing her taxable profit by £3,200.

Keep purchase invoices and dates. HMRC may ask for evidence, and proper documentation protects you in any dispute.

Marketing, Advertising & Business Promotion

Building your client base requires investment in marketing, and most costs qualify for tax relief.

Allowable Marketing Expenses

Website design and hosting costs

Social media advertising (Facebook, Instagram, LinkedIn)

Google Ads and paid search campaigns

Print advertising and direct mail

Business cards and promotional materials

Photography for product listings or portfolio

Video production for marketing purposes

Email marketing platform subscriptions

SEO and content marketing services

Professional design services

What's Not Allowed

Client entertainment or hospitality

Gift hampers (with exceptions for promotional merchandise under £50)

Event sponsorships that don't directly promote your business

Marketing is arguably one of the highest-ROI expense categories because it directly supports revenue growth while being fully deductible.

Professional Development & Training

Keeping your skills current is business-critical, and HMRC recognizes this.

Claimable Training & Development

Professional certification courses (accountancy, digital marketing, etc.)

Industry-specific workshops and seminars

Online courses improving job-relevant skills

Professional memberships and subscriptions (trade bodies, industry associations)

Books and learning materials for your trade

Conferences and professional development events

The key test: Does the training directly support your current business? Training that maintains or improves existing skills qualifies. Training that takes you into a completely new profession (e.g., learning graphic design when you're a plumber) generally doesn't.

Insurance & Professional Indemnity

Running a business without proper insurance is risky, and HMRC lets you claim the cost.

Claimable Insurance

Professional indemnity insurance (if required for your trade)

Public liability insurance

Business equipment insurance

Business interruption insurance

Employer's liability insurance (if you have staff)

Estimate £500–£2,000 annually depending on your sector. The more specialized your profession, the higher your insurance costs and the higher your deductions.

Common Mistakes That Cost Sole Traders Money

Mistake 1: Failing to Claim All Allowable Expenses

The most common error is simple: not realizing what qualifies.

Many sole traders claim home office but miss vehicle mileage. Others claim travel but forget office supplies, software subscriptions, or professional fees. Each missed category costs real money in additional tax.

Fix: Use a comprehensive expense checklist (provided below) and review it quarterly to catch missed categories.

Mistake 2: Mixing Business & Personal Expenses

Splitting a broadband bill between business and personal use is fine but you must apportion correctly.

If you pay £60 monthly for broadband and use it 70% for business, you can claim £42 (70% × £60). If you claim the full £60, you're over-claiming, risking HMRC challenge.

Fix: Keep detailed records showing the business-use percentage. Document this reasoning in case HMRC asks.

Mistake 3: Claiming Personal Commuting Costs

Travel between your home and regular place of work doesn't qualify no matter how you frame it.

Even if you call home your "office," regular commuting from home to a client site is personal travel. Only travel between client locations or to extraordinary business locations qualifies.

Fix: Track actual business journeys separately. Claim only genuine business mileage.

Mistake 4: Claiming Entertainment & Hospitality

You cannot claim the cost of entertaining clients, taking prospects to lunch, or offering gifts no matter the business purpose.

This surprises many sole traders, but HMRC draws a firm line: entertainment is personal, not business.

Fix: Budget entertainment as a non-deductible personal cost. Marketing is deductible; client dinners are not.

Mistake 5: Over-Claiming Home Office Without Documentation

Claiming 100% of your mortgage or rent when you work from home one day weekly raises red flags.

HMRC expects reasonable apportionment. If you use 10% of your home for business, claim 10% not 25% or 50%.

Fix: Document your business-use percentage clearly. Use simplified method (£26/month max) if you can't justify actual costs.

Mistake 6: Forgetting the "Wholly and Exclusively" Test

This principle catches many sole traders. Your home office must be used wholly (not partially) and exclusively (not also as a guest room) for business.

If you use your spare bedroom as a home office during business hours but as a guest room on weekends, you still qualify the test applies to business use times, not 24/7 isolation.

Fix: Document your business-use hours and purpose. Keep records showing exclusive business use during work times.

HMRC's Complete List of Non-Allowable Expenses

Beyond the mistakes above, HMRC explicitly disallows entire categories of spending:

Personal Living Expenses

Groceries and household food

Personal clothing (even if worn to client meetings)

Rent/mortgage payments (though home office proportion may qualify under specific conditions)

Gas and electricity for personal use

Capital Items (Subject to Different Rules)

Car depreciation (capital allowances apply instead)

Property improvements to your business premises (may qualify under different relief)

Penalties & Fines

Late tax payments or VAT penalties

Parking fines and traffic violations

Overdue bills and late fees

Professional Indemnity

Insurance excess payments (the insurance is deductible; excess is not)

Subscriptions & Memberships

Gym memberships

Donations to political parties

Charitable donations (though business sponsorships may qualify)

Debt & Financial Costs

Personal loan interest (only business loan interest qualifies)

Credit card interest on personal spending

The principle: if it doesn't directly support business operations or isn't required to run your business, HMRC won't allow it.

Your 2025 Sole Trader Expense Checklist

Use this comprehensive checklist to ensure you're claiming every allowable deduction:

Home & Office Expenses

Home office allowance (simplified or actual costs method)

Utilities (business proportion)

Buildings insurance (business portion if working from home)

Internet & broadband (business proportion)

Landline & mobile phone (business proportion)

Office furniture (desk, chair, shelving)

Stationery & printing supplies

Postage & courier services

Vehicle & Travel

Business mileage (at 45p/25p per mile)

Vehicle insurance (business use portion)

Vehicle maintenance & servicing (business use)

Fuel (business journeys only)

Parking fees & tolls

Train, bus, taxi fares (business journeys)

Hotel accommodation (business trips)

Meals while traveling (reasonable amount)

Professional & Financial Services

Accountancy fees (business portion only)

Solicitor & legal fees (business-related)

Bank charges

Bookkeeping software subscriptions

Payroll services (if you have staff)

Equipment & Technology

Computers & laptops (under £1M AIA limit)

Printers & peripherals

Cameras & photography equipment (if used for business)

Software licenses & subscriptions

Website hosting & domain renewal

Mobile device (business use proportion)

Marketing & Promotion

Website design & development

Digital advertising (Google, Facebook, Instagram)

Social media management software

Business cards & stationery design

Photography for product/portfolio

Email marketing platform

SEO & content services

Professional website maintenance

Insurance & Protection

Professional indemnity insurance

Public liability insurance

Business equipment insurance

Employer's liability (if staff employed)

Professional Development

Training courses & certifications

Professional conference attendance

Trade journals & publications

Professional body memberships

Online learning platforms

Specialist books & industry resources

Other Allowable Expenses

Raw materials & stock (if applicable)

Employee wages & salaries (if applicable)

Subcontractor fees

Packaging & shipping materials

Business subscriptions (industry-specific)

Permits & licenses (business-related)

FAQ: Common Questions About Sole Trader Expenses

Q: Can I claim my home office if I only work from home part-time?

A: Yes, absolutely. Even working 25 hours monthly qualifies under the simplified method (£10/month). The "wholly and exclusively" rule applies to the room or space during specific business times, not your entire home. If you work from your spare bedroom during business hours, you can claim even if you use it for personal purposes other times.

Q: What if I use my vehicle for both business and personal journeys?

A: You can only claim business mileage. Keep a detailed log or diary of business journeys. HMRC accepts sample period extrapolation if you're consistent and reasonable. Claiming 80% business use when you commute to a regular office twice weekly will trigger scrutiny. Document your actual mileage honestly.

Q: Do I need receipts for every expense?

A: For most expenses, yes keep receipts for at least six years. Exceptions include: the simplified home office method (£312 annually) requires no receipts, and vehicle mileage requires a mileage log, not fuel receipts. When in doubt, keep documentation.

Q: Can I claim accountancy fees if I do my own bookkeeping?

A: Only if you pay an accountant to prepare your accounts or tax return. If you do everything yourself, there's nothing to claim. However, if you pay software subscriptions (Xero, FreshBooks, Wave), those are deductible as office software.

Q: What if my accountancy invoice includes personal tax work?

A: Ask your accountant to itemize the invoice. Claim only the business portion. For example: £500 for business accounts preparation (claimable) + £200 for personal tax return (not claimable) = claim £500 only.

Q: Are pension contributions tax-deductible?

A: Yes. As a sole trader, you can contribute up to 100% of your net relevant earnings (after business expenses) or £60,000 annually, whichever is lower. Pension contributions reduce your taxable profit directly and receive full tax relief at your marginal rate.

Q: Can I claim meal expenses while working?

A: Only if traveling on business (overnight trip). Meals at your regular office don't qualify. This catches many sole traders you cannot claim your lunch expense, even if you eat at your desk working.

Q: What's the difference between cash basis and accruals accounting for expenses?

A: Under cash basis (simpler), you claim expenses when you pay them. Under accruals (traditional), you claim them when invoiced. For equipment over 2 years old, cash basis lets you claim the full cost immediately; accruals uses capital allowances instead. Ask your accountant which method you're using.

Q: Do I need to register for VAT to claim expenses?

A: No. All sole traders can claim allowable expenses regardless of VAT status. VAT registration is separate and depends on your turnover threshold (£85,000 for 2025/26).

Q: Can I claim costs for a side business or second income stream?

A: Yes, absolutely. Expenses related to any self-employment income are claimable. Keep them separate in your records, but all allowable business expenses reduce your overall tax liability.

Subscribe to our newsletter

Enjoy exclusive special deals available only to our subscribers.

Contact

Reach out for insights and support

Phone

+447768010239

© 2025. All rights reserved.